Note: The article was first published on Automobility Ltd written by Bill Russo, Benjamin Fan, and Lorenzo Song.

Opening Comments from Bill Russo:

In early 2009, shortly after resigning from my position as head of Chrysler’s business in North East Asia, I founded an Asia-based consultancy called Synergistics Limited. It was my way of staying close to the market where I had invested 5 years of my career, and which that same year had become the world’s largest automotive market measured by both sales and production. At that time, it had become quite apparent that China had emerged as the front line in the battle for dominance of the 21st century automotive industry.

To gather my thoughts on where things were likely headed, I wrote an article in 2009 titled The Path to Globalization of China’s Automotive Industry where I predicted the emergence of Chinese brands as global players, and described a plausible path for this to occur. China surpassed Japan in 2023 to become the world’s largest exporter of vehicles, and surpassing this milestone represents an appropriate time to revisit this topic.

Where We Stand in 2024

- China has emerged as a transformative force in the global auto industry, having been the world’s largest market for production and sales of automobiles since 2009

- New Energy Vehicles now represent more than one-third of all vehicles sold in China, and Chinese companies have 80% of this segment.

- Over 60% of new energy vehicles and 70% of EV batteries are made in China

- Chinese brands now have 63% share of domestic passenger vehicle sales, up 27% since 2020.

- A recent slowdown in domestic sales has forced automakers in China to prioritize exports in order to improve the utilization of their installed capacities. As a result, 20% of the vehicles produced in China are exported and it is the largest car export nation in the world.

- With the world’s largest population, mobility demand in China is served by an increasingly diverse set of solution providers, including internet-backed Smart EV players, the equivalent of which do not exist outside of China.

- With the world’s largest digital economy, new players are emerging on the Chinese competitive landscape that view the car as a smart device. This has a direct impact on the product configuration with cars incorporating internet-era features to provide rich digital experiences.

- Facing rising geopolitical tensions and trade barriers, leading Chinese brands will likely accelerate the move from made-in-China exports to globalizing their production and supply footprint.

The Center of Gravity in the Global Auto Industry Moves East

While internal combustion engine (ICE) powered automobiles were invented in Germany in the mid-1880s, mass commercialization of automobiles emerged a few decades later in the early 20th century United States. Henry Ford, Alfred Sloan and Walter P. Chrysler led the Big 3 US automakers from an initially fragmented startup landscape. By 1950, the United States produced over three quarters of all the cars in the world, and Detroit was the epicenter of the global automotive industry (see Figure 1).

After World War II, Germany and Japan emerged as automobile production hubs, initially to serve their domestic markets. However, momentum decidedly shifted over to East Asia in the latter part of the 20th century as oil supply shocks rocked the global economy. As a result, consumer preferences around the world shifted toward makers of small, affordable and more fuel-efficient cars produced by Japanese and later Korean automakers.

Toyota and its lean production system with emphasis on quality, continuous improvement and supply chain management posed an existential challenge to the historical dominance of the US automakers. By 1990, Japan surpassed the United States to become the world’s largest car producing nation.

Over the next decade the US temporarily regained its position as the world’s largest car producing nation as German, Japanese and Korean automakers shifted from an export-oriented model to a more globalized production and supply footprint.

In the 21st century, China became the growth engine for the world’s automakers, contributing nearly all of the growth in automotive industry production and sales volumes since 2000. Global carmakers flocked to China to sell their products to a large and growing population of consumers, while simultaneously leveraging scale and cost advantages to increase their unit margins. Today, nearly one-third of all cars produced in the world are made in China.

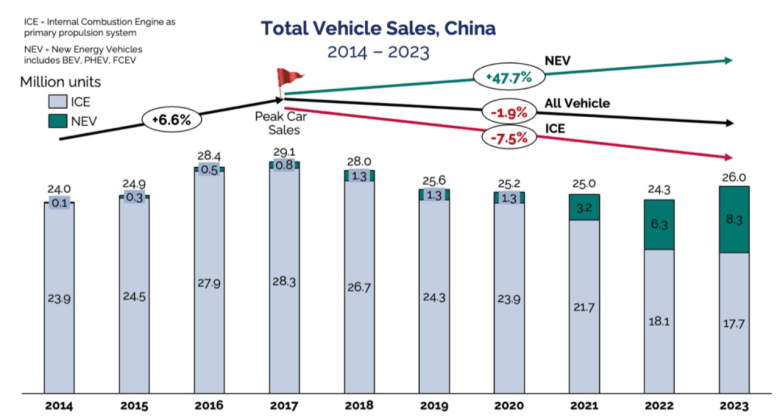

However, global new car sales demand has not kept pace with the growth in production capacity. Global sales of new vehicles peaked in 2017 at 96.1 million units (See Figure 2). Sales in China in 2017 also peaked at ~30 million units, representing just over 30% of the world’s demand for new vehicles.

Peak Sales and the Rise of New Energy Vehicles

The China automobile market has changed dramatically since 2017, with new car sales declining ~2% on a compound annual basis (see Figure 3). Over this period, demand has also shifted in favor of New Energy Vehicles, which have risen by ~48% on a compound annual basis. Clearly, there has been a dramatic reversal of growth along with a shift in consumer preference.

Domestic sales of ICE powered vehicles have fallen by nearly 11 million units while sales of New Energy Vehicles have risen by 7.5 million units over this period (see Figure 4). Faced with this sudden domestic sales slowdown and shift in consumer preference, carmakers are turning to exports as a way to recapture growth. Exports have risen from 1.1 to 4.9 million units over this period. More that three-quarters of these exports are the pure gasoline powered vehicles that are no longer the first choice preference of Chinese consumers.

Three Waves of Automobility Disruption

China’s emergence as the leading global automobile market is not just a story of growth and scale leading to eventual globalization. While this pattern has happened in the past with German, Japanese and Korean carmakers, mobility problems are solved in a different way in China and often involves a different landscape of solution providers.In the late 20th century, Japanese and later the Korean carmakers gained relevance by building cars more efficiently with improved quality control and efficient supply chain management. Led by developments in China, the global industry now is experiencing a more fundamental shift, where the industry business model is being transformed by technology.

While electrification is perhaps the most clear discontinuity when viewed through the lens of the traditional industry, there is a far more transformative force being exerted by China’s internet economy as it enters into the business of serving mobility demand.We are at the early stage of mobility revolution sparked by entrance of internet and communications technology (ICT) players in the mobility sector. The internet population in China reached nearly a billion users by the end of 2020, providing a huge market for services-oriented demand aggregation. Virtually all of China’s population is served by mobile internet platforms that provide services that involve people or goods movement – and the internet economy is actively investing to optimize the economics of services that invoke some form of mobility.

Entrepreneurial private enterprises have emerged from the digital economy to invest in mobility innovation. As a result, the information and internet technology revolution that started in the late 20th century is now acting as an accelerating force for mobility innovation. The creation and commercialization of the consumer-oriented internet has transformed devices we interact with daily into service-oriented, software-defined platforms.

Digital platform players including China’s internet giants (Baidu, Alibaba and Tencent) and smart device makers (Huawei and Xiaomi) are investing heavily to create smart solutions that unlock new recurring revenue streams linked to mobility, energy and other online and offline services.

China’s digital economy is setting the pace for an entirely new services-centric business model where “new game” commercial opportunities are created. This “new game” is highly embedded in the digital ecosystem and will change the car from a device monetized primarily when sold to a device monetized in multiple ways over its productive life cycle. New Game players often emerge from digital ecosystems and have experience monetizing other software-defined smart devices, and are highly efficient aggregators of services that are accessed through smart devices.

The disruptive forces that are emanating from China and its automotive industry are not merely driving a shift in propulsion technology. Public sector support combined with private sector entrepreneurship and the massive scale of internet economy are disrupting the traditional automotive industry and reshaping the sector in three waves (see Figure 5). The three waves of “automobility” disruption are enabled by technology and are making mobility solutions more affordable and accessible.

![Figure 5 | Three Waves and Timeline of Automobility Disruption: [Shared, Connected, Electric and Autonomous Mobility]](https://i0.wp.com/technode.com/wp-content/uploads/2024/09/5.webp?resize=780%2C463&ssl=1)

The 3 waves of this “Automobility Revolution”form the underlying thesis of our company since we were founded in 2017. This thesis has proven to be an accurate prediction of how the business model is transformed by technology – which is manifesting far faster in China than elsewhere.

We live in an era where big data is used to provide personalized services that are often accessed through a smart device, powered by the mobile internet. These smart device technologies are now being incorporated into the devices that transport people and goods, which will revolutionize the business of how these mobility devices are monetized. This began in with app-based on-demand mobility solutions, which scaled rapidly in China in the Automobility 1.0 era.

Mobility services provide access to daily life needs and conveniences, linking us between the places we live, work and play. Multi-modal traffic systems, parking infrastructure, charging stations, public services have all become available through on-demand platforms, bringing investments from the internet giants and device players.

China’s auto sector has fully embraced the “Smart EV” or “Intelligent Connected Vehicle (ICV)” in the Automobility 2.0 era. As a result, we are witnessing a rapid acceleration of the commercialization of new energy vehicle (NEV) propulsion technology and advanced driver assistance systems (ADAS), making mobility safer, more economical and partially freeing the driver from the mundane task of actuating the vehicle.

This will lead to the Automobility 3.0 autonomous mobility on demand (AMOD) era, where people (robo-taxi) and goods (robo-delivery) movements are automated. Of course, driver-actuated mobility will co-exist with such devices, but the overall economic advantages of smart, autonomous vehicles will spark large-scale commercial deployment.

With its large and commercially aggressive digital economy, China is effectively transforming the traditional product-centric automotive industry business into a services-centric Internet of Mobility (IoM) business model.

When the vehicle is conceptualized as a smart device, it collects information on the users, the vehicle, and its surroundings. All the data generated from the vehicle and users can be uploaded to the cloud for analytics to better provide data-enabled services to users in vehicles (see Figure 6).

By configuring vehicles to be smart and interconnected, China is leading the way toward integrating Smart EVs into broader ecosystems, such as energy management. This integration not only serves as a model for global markets but also underscores the potential for Smart EVs to play a crucial role in the sustainable management of urban energy systems. This development is further described in our article “From Smart EV to Smart Grid: Building the Internet of Energy Ecosystem”.

How IoM Impacts Product Configurations: Smart EV/ICV Case Examples

This “Internet of Mobility” revolution is happening faster in China and at an unprecedented scale, guided by supportive government policies and backed by investments from the world’s largest digital economy.

With the rise of the mobile internet, smart devices have become a de-facto way for the more than 1 billion internet users in China to conveniently access services where mobility is required – these include ride hailing, e-commerce, and food delivery (see Figure 7).

As key stakeholders in the mobility value chain, internet companies exert a transformative force on the traditional automotive value chain. Internet-backed mobility players place user-centric mobility services – not just product hardware sales and service – at the center of their value chain (see Figure 8), while prioritizing the monetization of services that can be delivered through their app-enabled digital ecosystems.

This places higher emphasis on configuring the vehicle with internet-era features which optimize the ability for an Intelligent Connected Vehicle (ICV) to aggregate vehicle and user data in order to unlock new recurring revenue streams (see Figure 9).

Backed by the world’s largest digital economy, Chinese car makers are redefining premium as vehicles designed to deliver upgraded in-cabin user centric experiences, often leveraging internet-era features and technology. By doing this, they are able to generate recurring after sales revenues linked to their digital ecosystem. Several of China’s digital natives are also building the operating systems for the Intelligent Connected Vehicle (ICV). Examples include Huawei’s Harmony OS, Xiaomi’s MiOS, Alibaba’s AliOS, etc.

Consequently, features that unlock unique digital experience for all occupants – have become essential among Chinese consumers. While still important, driving experience is no longer the main purchase criteria. Brands that are late to recognize the importance of digital experience are left with a much weaker market position compared with a few years ago.

Figure 10 provides examples of how several internet-backed Smart EV players are influencing product configurations, and in the process are able to command pricing power based on their ability to deliver a differentiated in-cabin digital experience.

Figure 11 provides an example of how legacy automakers like BYD and its family of brands can also embrace this trend, incorporating unique in-cabin designs that provide their customers a differentiated experience of mobility.

What Happens in China WILL NOT Stay in China

Unlike Las Vegas, what happens in China will not stay in China. At least not as it pertains to the Future of Mobility. In fact, Made-in-China is already going global in a big way.

China’s domestic automotive market peaked in 2017, in part resulting from the diversity of mobility solutions that now compete with new car sales. This includes growth sales of previously owned vehicles that offer an affordable alternative to purchasing a new car. In addition, the wide embrace of on-demand mobility solutions offers an affordable alternative to car ownership for urban commuters.

Although there has been a small domestic sales recovery since 2020, we do not expect a big expansion of demand for new cars in the coming years. Rapid growth in NEV demand since 2020 has placed considerable pressure on companies producing gasoline powered vehicles, exposing a severe capacity overhang in China.

As a result, local and foreign carmakers in China are faced with a choice: find markets outside of China to buy these vehicles or close factories that are no longer needed to serve the domestic market. Most carmakers have chosen to aggressively expand exports since 2020 (see Figure 12).

As noted earlier, more than three-quarters of these exports are pure gasoline powered vehicles that are no longer preferred by Chinese consumers. While Chinese consumers have shifted in their buying preferences toward Smart EV/ICV configurations, the same cannot be said for consumers in the rest of the world, where gasoline powered vehicles with limited digital content still prevail. This provides an opportunity to reallocate these capacities to the global markets.

Chinese companies will now encounter the risks that highlighted in the 2009 edition of The Path to Globalization of China’s Automotive Industry. However, the world of 2024 has been transformed by the mobile internet, and Chinese companies are far more evolved and capable players in this new “Internet of Mobility” game.

The “Two Worlds” Scenario

Going forward, we see the auto industry moving toward a “Two Worlds” scenario by 2030 (see Figure 13). Carmakers from developed (W2) regions like US, EU, Japan and Korea remain committed to their traditional product, technology and business model preferences and only change incrementally.

However, another world (W1) has emerged, led by China. In this world, mobility problems are solved with shared, connected, electric and intelligent solutions. These solutions are delivered affordably by leveraging efficient and highly scaled supply chains.

We believe Emerging Markets (W3) in regions like Southeast Asia, Central and South Asia, Middle East, Africa and Latin America will gravitate toward affordable solutions that leading Chinese carmakers can offer. The rapid growth in demand for Chinese cars in W3 regions offers evidence that this is already happening.

There is strong evidence that Chinese carmakers can gain acceptance in the W2 regions as well. However, protectionist tariffs have been erected in the US and EU, forcing Chinese carmakers to expand beyond “Made-in-China” even faster.

The Path to Globalization – 2024 Edition

Faced with a slowing domestic market and overcapacity, Chinese carmakers are going global rapidly by leveraging exports. In 2024 through July, about 1 of every 5 Made-in-China cars were exported to many destinations (see Figure 14).

![Figure 14 | Top 10 Made-in-China Vehicle Export Destinations [January - July 2024]](https://i0.wp.com/technode.com/wp-content/uploads/2024/09/14.webp?resize=780%2C464&ssl=1)

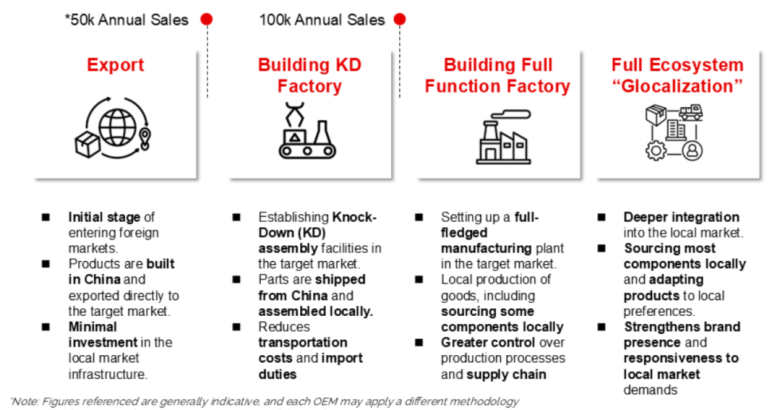

While exporting vehicles is a way to get started in the global markets, it is not the most efficient business model. Tariff and trade barriers place significant additional costs on top, forcing companies to consider regionalizing their production and eventually their supply chains in order to navigate these challenges.

As regional demand expands, the business model evolves to toward knock-down (KD) assembly of parts sourced from the home country. As volume expands further, fully functional assembly of parts sourced in the regional markets eventually supplants the centralized Made-in-China export model. Ultimately global companies act locally in putting a “glocalized” hybrid ecosystem together (see Figure 15). This path is similar to what other global automakers like Volkswagen, Toyota, Hyundai and others have achieved.

Building robust regional supply chains and forming partnerships with distributors will become essential as companies seek to establish their footprint in the overseas markets.

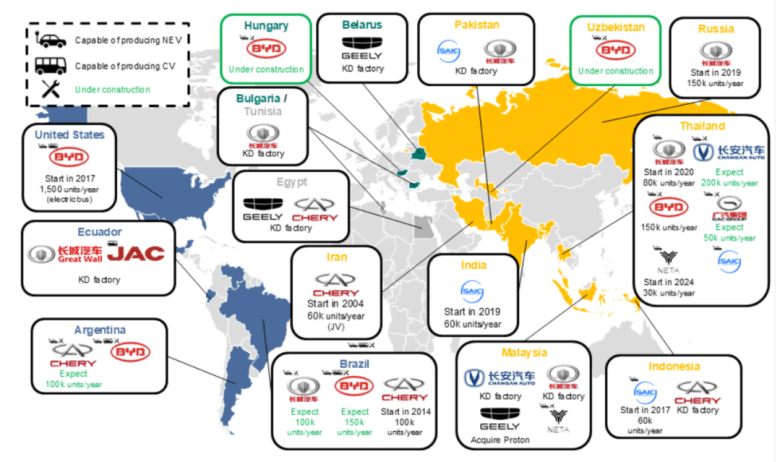

Several Chinese carmakers (led by Chery, Great Wall, Geely and SAIC) have been investing to build capacities in overseas market even before the rise of China’s New Energy Vehicles (see Figure 16).

Recently BYD, the number 1 EV maker in China, has made a significant shift to regionalize their production in Thailand, Hungary, Turkey, Brazil and Mexico.

While tariff protections are a means of slowing the export of Made-in-China cars, they also encourage the carmakers to move more quickly to globalize their production and supply footprint.

Closing Comments from Bill Russo:

My 2009 paper was a thought experiment on what it would take for Chinese carmakers to emerge on the global stage.

In 2024, China makes nearly one third of all cars in the world, nearly two thirds of all electric vehicles, and 70 percent of EV batteries. The globalization of Chinese carmakers is a fact and it is a game-changer on many levels.

With a domestic market that is not providing an opportunity for growth, automakers in China have prioritized exports in order to improve the utilization of their installed capacities. As a result, 20% of the vehicles produced in China are exported and it has quickly become the largest car export nation in the world.

At the same time, demand for New Energy Vehicles has expanded rapidly and now represents more than one-third of all vehicles sold in China, and Chinese companies have ~80% of this segment.

The unique capability for Chinese carmakers to offer affordable technology-enabled solutions has resulted in a complete realignment of the competitive landscape, where Chinese brands now have 63% share of domestic passenger vehicle sales, up 27% since 2020.

With the world’s largest digital economy, new players are emerging on the Chinese competitive landscape that view the car as a smart device. This has a direct impact on the product configuration with cars incorporating internet-era features to provide rich digital experiences.

Facing rising geopolitical tensions and trade barriers, leading Chinese brands will likely pivot from Made-in-China exports to globalizing their production and supply footprint.

Global automakers are now faced with the challenge of how to cope with the rise of Chinese companies both in China as well as in the markets around the world. We believe that Chinese companies may struggle in their efforts to go global, but several will ultimately prevail to become global leaders.

The time to act is now for global carmakers, suppliers, and dealers to leverage their global presence and capabilities by engaging with the leaders emerging from China via M&A, strategic partnership, joint R&D, and joint ventures.

Going global together with the new players emerging from China may be the best way forward. The alternative of retreating from China cannot prevent the Chinese from going global on their own.